Metaplanet’s Latest Move: $130M Loan Fuels Bitcoin Expansion

- Metaplanet, a company listed in Tokyo, has borrowed another $130 million against its Bitcoin to buy more Bitcoin and grow its businesses that are related to it.

- This means that the total amount of loans from its $500 million facility is now $230 million, backed by more than 30,000 BTC worth about $3.5 billion.

- The company wants to use the money to buy Bitcoin, sell options to make money, and maybe buy back its own stock.

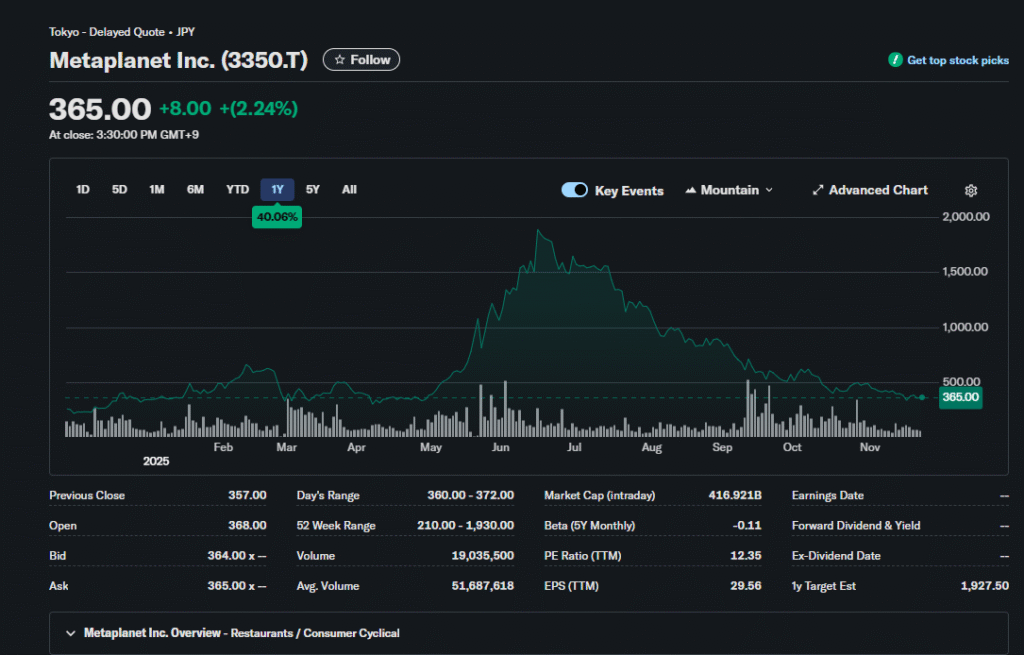

Data:https://finance.yahoo.com/quote/3350.T/

On November 25, 2025, Metaplanet said that it had taken out a $130 million loan on November 21. This is part of a $500 million credit line that the company got by putting up its Bitcoin as collateral. The loan is renewed every day, and the interest is based on a U.S. dollar rate plus a spread. You can pay it back at any time.

The lender doesn’t want to be named, so they aren’t. This draw means that Metaplanet has now used $230 million of the facility. It has 30,823 BTC, which is worth about $3.5 billion as of October 31. This is strong collateral, even if Bitcoin prices drop sharply.

The new money will mostly go toward buying more Bitcoin, which will help Metaplanet build up its treasury. It also helps Bitcoin income operations grow, like using BTC as collateral to sell options and make money.

If the market is right, some of the money could be used to buy back company stock. This is similar to how companies like MicroStrategy see Bitcoin as a key asset for growth.

Metaplanet used to be all about hotels, but now it’s a leader in Bitcoin treasury. It trades on the Tokyo Stock Exchange (code 3350) and OTCQX as MTPLF. Its main strategy for dealing with changes in the economy is to hold Bitcoin.

After the news, shares rose 2.24% to 365 yen. However, they are still down more than 80% from their peak in June. This loan comes after a recent $150 million perpetual preferred equity raise, which gives them more ways to get money.

In a rising market, borrowing against Bitcoin to buy more is a smart move, but it can be risky if prices drop. Metaplanet’s conservative buffers, which only draw when there is enough collateral, show that they know how to manage risk well. This shows that companies trust Bitcoin as a long-term store of value, which could inspire others.

According to the company’s statement, the financial effect for 2025 is thought to be small.